Financial education can help build a more equitable and sustainable society from an economic, social and environmental point of view.

According to the OECD, financial literacy is able to promote the sustainable development of society by ensuring the financial well-being and economic stability of individuals, families, businesses, and thus promoting fairer and more sustainable development.

The data shows that citizens with adequate financial skills are able to manage their resources in a more rational and balanced way. A good level of financial literacy appears, in fact, to be correlated with a greater ability to consciously manage money and a lower propensity to get into too much debt.

All this translates into the achievement of greater well-being not only on an individual but also on a collective level.

The ability to pursue objectives through saving, adopting a long-term perspective, is fundamental to overcome the “now” culture and accustom citizens to evaluating the impact of their choices over time, in particular on future generations.

Financial literacy and the habit of “zero waste” can become an integral part of an educational approach consistent with sustainable and inclusive growth. It is important that this cultural change involves the youngsters of the so-called “Generation Z” not only because the near future is in their hands, but also because they are the best ambassadors of economic and environmental sustainability within the family.

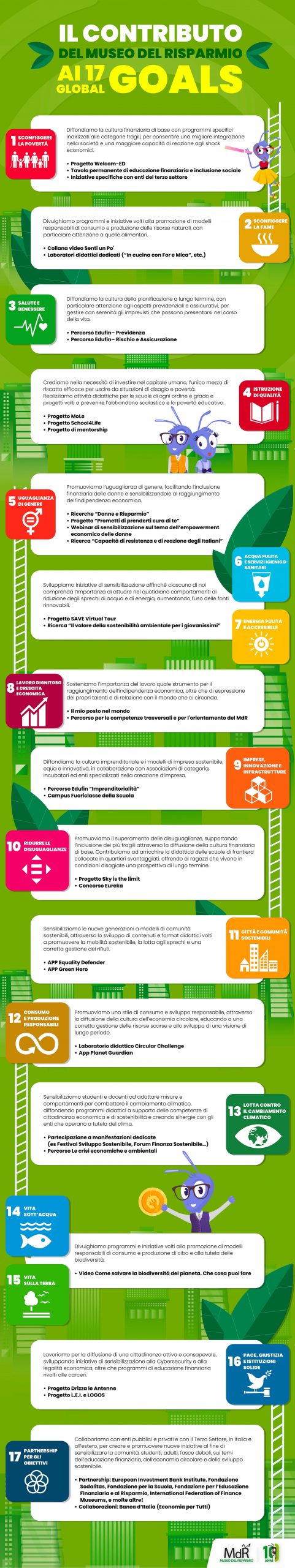

The contribution of the Museum of Saving to the 17 Global Goals

Through the initiatives and contents of the Museum of Saving, we offer an active contribution to achieving the 17 Sustainable Development Goals indicated in the 2030 Agenda.

Find out how! Here are some examples: