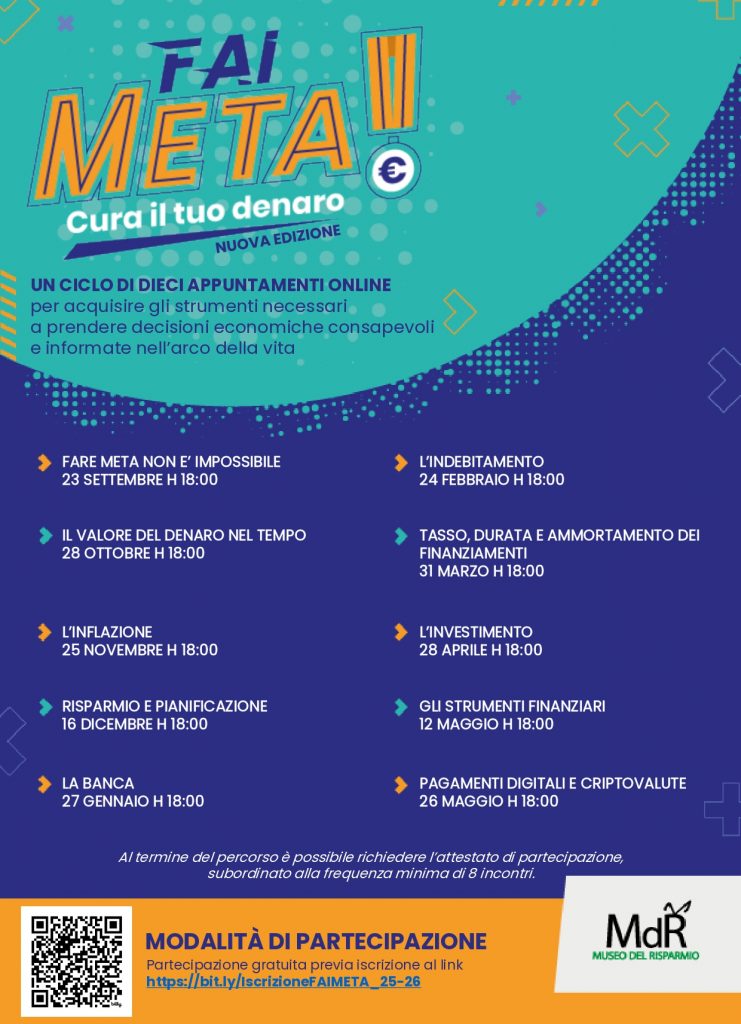

LET’S SCORE A TRY! Take care of your money

New edition

Not a traditional economics course with lectures, but an edutainment initiative focused on interaction and learning by doing—an approach that characterizes all the activities of the Museum of Saving.

“LET’S SCORE A TRY! Take care of your money” is a training program designed to equip youngsters and adults with the essential skills needed to make informed and rational financial decisions, helping them achieve economic peace of mind and well-being for themselves and their families.

The program uses metaphors and references from the world of sports, since the mindset and skills needed to cultivate physical and mental well-being are in many ways similar to those required for financial well-being.

The program consists of 10 one-hour online sessions.

Each session includes both theoretical content and interactive activities. Participants will watch videos produced by the Museum of Saving and take part in quizzes, tests, polls, and multimedia games, all enriched by meaningful references to sports.

The modules

- Scoring is Possible – September 23, 6:00 PM

This session explores the similarities between sports and financial awareness. It introduces key psychological biases that affect financial decisions, with examples from both sports and economic contexts.

- The Value of Money Over Time – October 28, 6:00 PM

Is one euro today worth more than one euro tomorrow? This session introduces the concept of the time value of money and explains interest—how it works and the difference between simple and compound interest. It also explores how compound interest applies to loans and the so-called “snowball effect”.

- Inflation – November 25, 6:00 PM

With inflation being a hot topic, this module explains its causes and effects—on consumption, savings, income, and investments. It also explores hyperinflation and the role of central banks, particularly the European Central Bank.

- Saving and Planning – December 16, 6:00 PM

What’s the link between income, spending, and saving? How do you manage a personal or family budget? This session presents a simple planning process for achieving financial goals and highlights the importance of maintaining quality of life after retirement.

- The Bank – January 27, 2026, 6:00 PM

After discussing the economic and social role of banks, this module introduces key banking tools and services, explains how they work, and discusses the associated costs. It also introduces consumer credit and how it functions.

- Debt – February 24, 2026, 6:00 PM

This session focuses on the relationship between planning and debt, and how to manage debt responsibly. It covers common forms of borrowing such as personal loans, with a focus on home mortgages and their main features. The issue of usury is also addressed.

- Interest Rates, Loan Terms, and Amortization – March 31, 2026, 6:00 PM

How do you navigate loans and mortgages? This session explains the difference between fixed and variable rates, the impact of loan duration on monthly payments, and how to choose wisely. It introduces amortization plans and explains the most common repayment models.

- Investing – April 28, 2026, 6:00 PM

What should we know before investing? What is the relationship between risk and return? After defining investment and its goals, the session explores common types of investments and the balance between expected return and risk.

- Financial Instruments – May 12, 2026, 6:00 PM

Can investment risk be reduced? What’s the difference between stocks and bonds? This session introduces the concept of diversification and describes common financial instruments (stocks, bonds, mutual funds, derivatives), analyzing their pros and cons in relation to different investor profiles.

- Digital Payments and Cryptocurrencies – May 26, 2026, 6:00 PM

Digital payment tools are fast and convenient—but also come with risks. This session outlines the landscape of digital payments, their benefits and drawbacks, and common fraud tactics. It also introduces digital currencies (with a focus on the digital euro) and explains the basics of cryptocurrencies.

How to participate

Participation is free, but registration is required via this link IscrizioneFAIMETA_25-26.

At the end of the course, participants who attend at least 8 sessions can request a certificate of participation by writing to info@museodelrisparmio.it.