Saving money doesn’t necessarily mean giving up fun. Enjoying life without emptying your wallet can be simpler than you might think.

Here’s a list of practical tips to spend less without sacrificing enjoyment:

- Start with a Budget

The first step to saving is knowing exactly how much you earn and how much you spend. Keeping a monthly record of income and expenses helps identify areas where you can cut costs.

- Save a Little, Every Day

Small changes to daily habits can make a big difference: for instance, preparing lunch at home to bring to work instead of eating out every day can save you significant amounts.

- Fun is Easy!

You don’t need to spend a fortune to have fun.

To prove it, explore free or low-cost activities in your city: there are sure to be cultural events, urban hikes, picnics in parks, and free (or very affordable) concerts in squares and venues.

Hosting dinners and movie nights at home can also be a great way to socialize at minimal cost.

- Save on Energy

Reducing energy consumption is not only eco-friendly but also saves money. With small changes—like turning off lights when leaving a room, using energy-efficient appliances, and limiting the use of heating and air conditioning—you can achieve significant savings.

- 6. Use the 50/30/20 Method

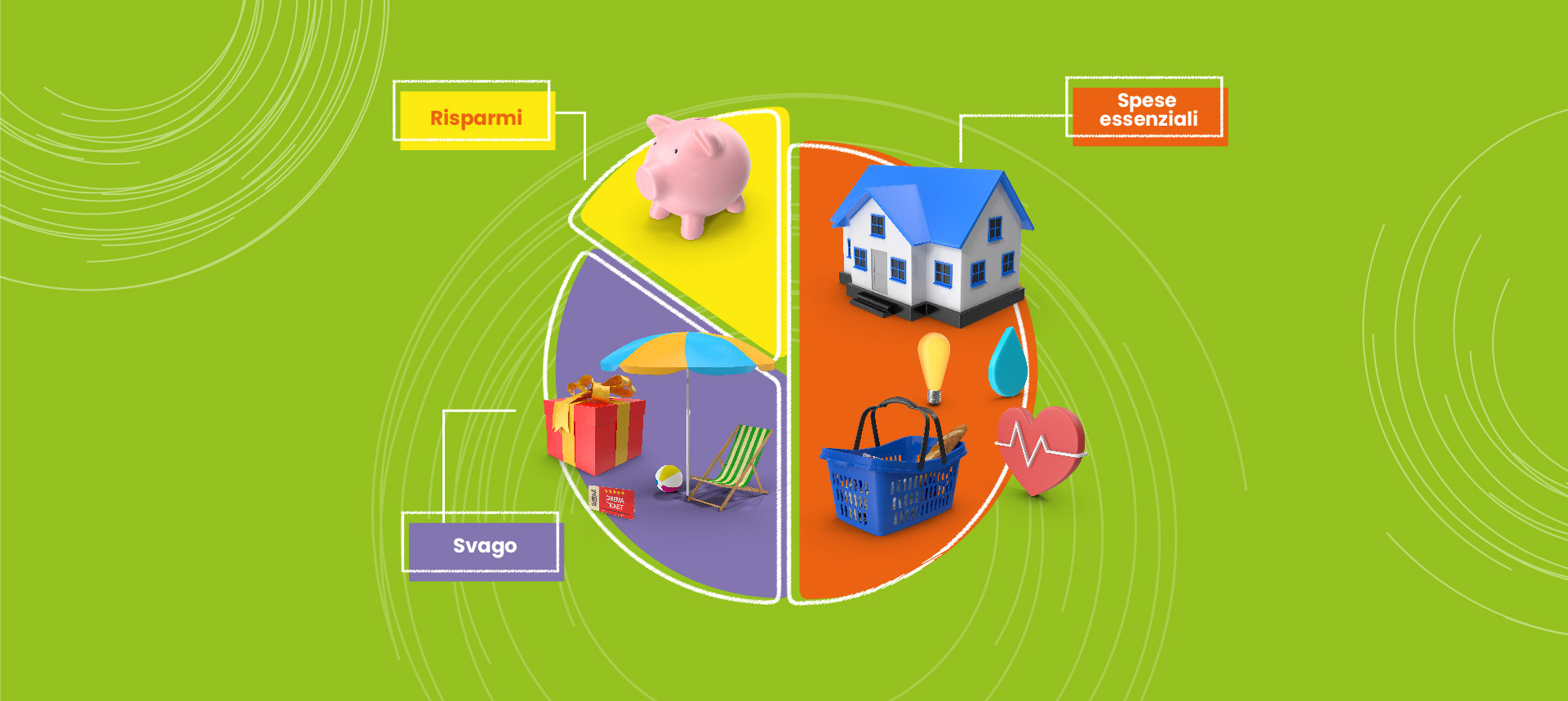

An effective savings strategy is the 50/30/20 method. How does it work?

Allocate 50% of your income to necessities, 30% to wants and entertainment, and 20% to savings: a simple and accessible solution that helps you manage your finances in a balanced way.

- Explore the Sharing Economy

The sharing economy offers great opportunities to save. Today, you can use car-sharing and bike-sharing services to cut transportation costs, both for long trips and short commutes in the city

- Track Your Progress!

It’s important to monitor your progress: celebrating small wins keeps you motivated and encourages you to stick with your new saving habits.

To regularly check your finances, you can also use financial management apps to track expenses.

When it comes to mindful spending, there’s no one-size-fits-all rule: the key is to adopt strategies that align with your lifestyle and are sustainable over time.

The Museum of Saving organizes a wide range of in-person and online events aimed at making financial education simple, fun, and truly accessible to everyone.

To learn more, visit our website and keep reading our blog.

October 10, 2024