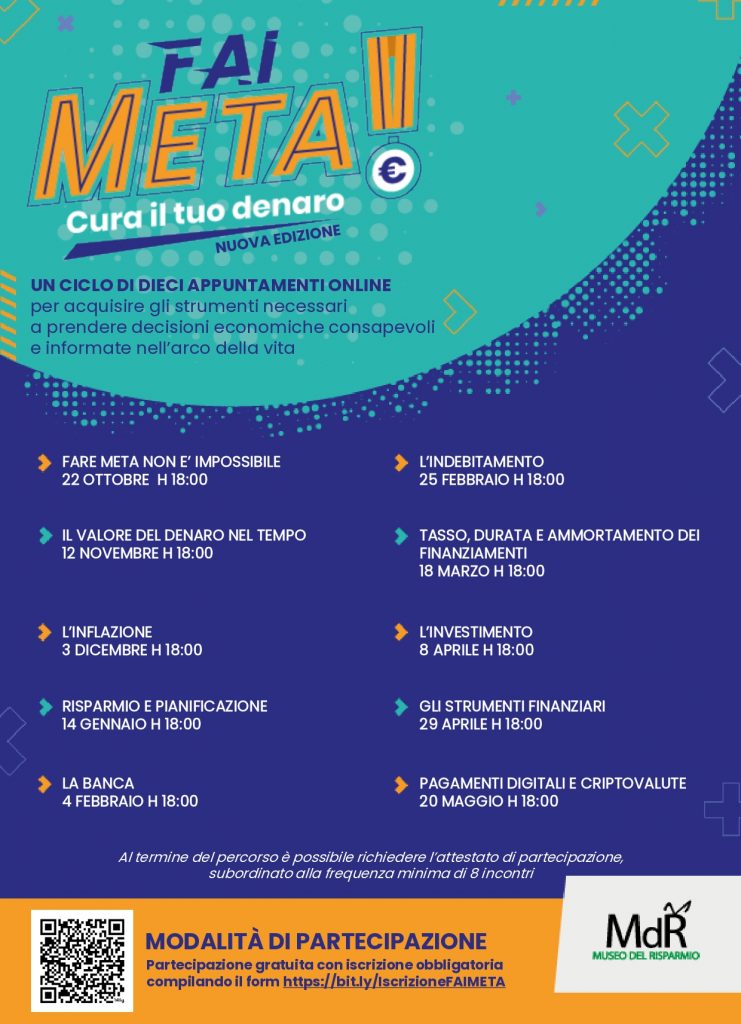

LET’S SCORE A TRY! Take care of your money

New edition

Not an economics course with frontal lessons, but an edutainment initiative that favors interaction and learning through doing and involvement: an approach that distinguishes all the activities of the Museum of Saving.

“LET’S SCORE A TRY! Take care of your money” is a training course designed to provide young people and adults with the basic skills to consciously and rationally deal with financial decisions and achieve serenity and economic well-being, for themselves and their families.

The course uses metaphors and references to the world of sports, because the attitude and skills needed to cultivate our psychophysical well-being are in many ways similar to those needed to take care of our financial well-being.

LET’S SCORE A TRY! is developed in 10 online meetings of one hour.

Each meeting alternates theoretical moments and interactive moments. Participants will watch some videos of the Museum of Savings and will be involved in small quizzes, tests, surveys and multimedia games, with different and appropriate references to the world of sports.

Modules

- Scoring is not impossible – October 22, 6:00 p.m.

This module will examine the aspects that bring sport closer to economic awareness and introduce the main psychological conditioning factors that hinder our financial choices. We will refer to examples from the economic and sports fields.

- The value of money over time – November 12, 6:00 p.m.

Is a euro worth more today or tomorrow? Having clarified the concept of “time value of money”, we will introduce the concept of interest – as a tool for making money grow – explaining how it works and distinguishing between simple and compound interest. We will also see the application of the compound interest rate in financing contracts and the resulting “avalanche” effect.

- Inflation – December 3, 6:00 p.m.

Today we talk a lot about inflation: in this module we will explain the causes and effects of this phenomenon, in particular on consumption and investment choices, on income and savings. We will also offer an in-depth look at hyperinflation and the role of central banks, with particular reference to the European Central Bank.

- Savings and planning – January 14, 2025, 6:00 p.m.

What is the relationship between income, consumption and savings? How can you properly manage your personal and family budget? This module will illustrate the planning process, which allows you to plan your economic behavior in order to achieve a goal through a few simple steps; its benefits and importance will be clarified, with a view to maintaining your standard of living after your career and in retirement.

- The bank – February 4, 2025, 6:00 p.m.

After explaining the role of banks in the economic and social sphere, their main tools and services will be introduced. How they work will be illustrated and the costs involved in banking operations will be examined. Finally, we will mention the forms of consumer credit, which allow customers to borrow money under certain conditions and costs.

- Debt – February 25, 2025, 6:00 p.m.

After having clarified the relationship that must exist between planning and debt, and clarified what its correct management consists of, the most common form of debt, the loan, will be presented, illustrating its characteristics and main purposes. Among these, real estate investment stands out, which can be achieved through a mortgage, presenting its various aspects. In conclusion, the phenomenon of usury will be analyzed.

- Interest rate, duration and amortization of loans – March 18, 2025, 6:00 p.m.

Mortgages and financing: how to find your way? This module will introduce the difference between fixed and variable interest rates and their impact on the mortgage payment. The consequences of the different duration of a loan will be analyzed, and some useful advice will be provided for choosing. It will then explain what an amortization plan is, or the mechanism underlying the repayment of a loan, distinguishing between the most common types.

- Investment – April 8, 2025, 6:00 p.m.

What do we need to know before investing? What is the relationship between risk and return? After an introductory explanation of what investment is, the analysis of its objectives and the examination of the common characteristics of some of its forms, attention will be focused on financial investments, their return and the inseparably connected risk.

- Financial instruments – April 29, 2025, 6:00 p.m.

Is it possible to mitigate investment risk? How do stocks and bonds differ? This module will illustrate the concept of diversification, which every investor should be well aware of. The most common financial instruments (stocks, bonds, funds, derivatives) will then be described, examining their pros and cons in relation to the specific characteristics and profile of the investor.

- Digital payments and cryptocurrencies – May 20, 2025, 6:00 p.m.

Digital payment tools are convenient and fast, but they present some risks that you need to pay attention to. After outlining the scenario of digital payments, explaining their advantages and disadvantages, the context of related frauds will be presented and some valuable suggestions will be provided to recognize and avoid them. The specificity of digital currency will also be illustrated (with particular reference to the digital euro) and the phenomenon of cryptocurrencies will be introduced.

How to participate

Participation in the meetings is free with mandatory registration by filling out the form https://bit.ly/IscrizioneFAIMETA.

At the end of the course, it is possible to request a certificate of participation, subject to a minimum attendance of 8 meetings.

For further information, write to info@museodelrisparmio.it