A series of meetings designed to help women invest consciously, rebalance family responsibilities, and plan for a secure retirement.

Throughout their lives, women face a range of economic disadvantages that affect their financial independence and their ability to build long-term well-being.

Pay gaps and career discontinuity linked to the unequal distribution of family care work expose women to fewer income opportunities, lower pensions, and a higher risk of poverty later in life.

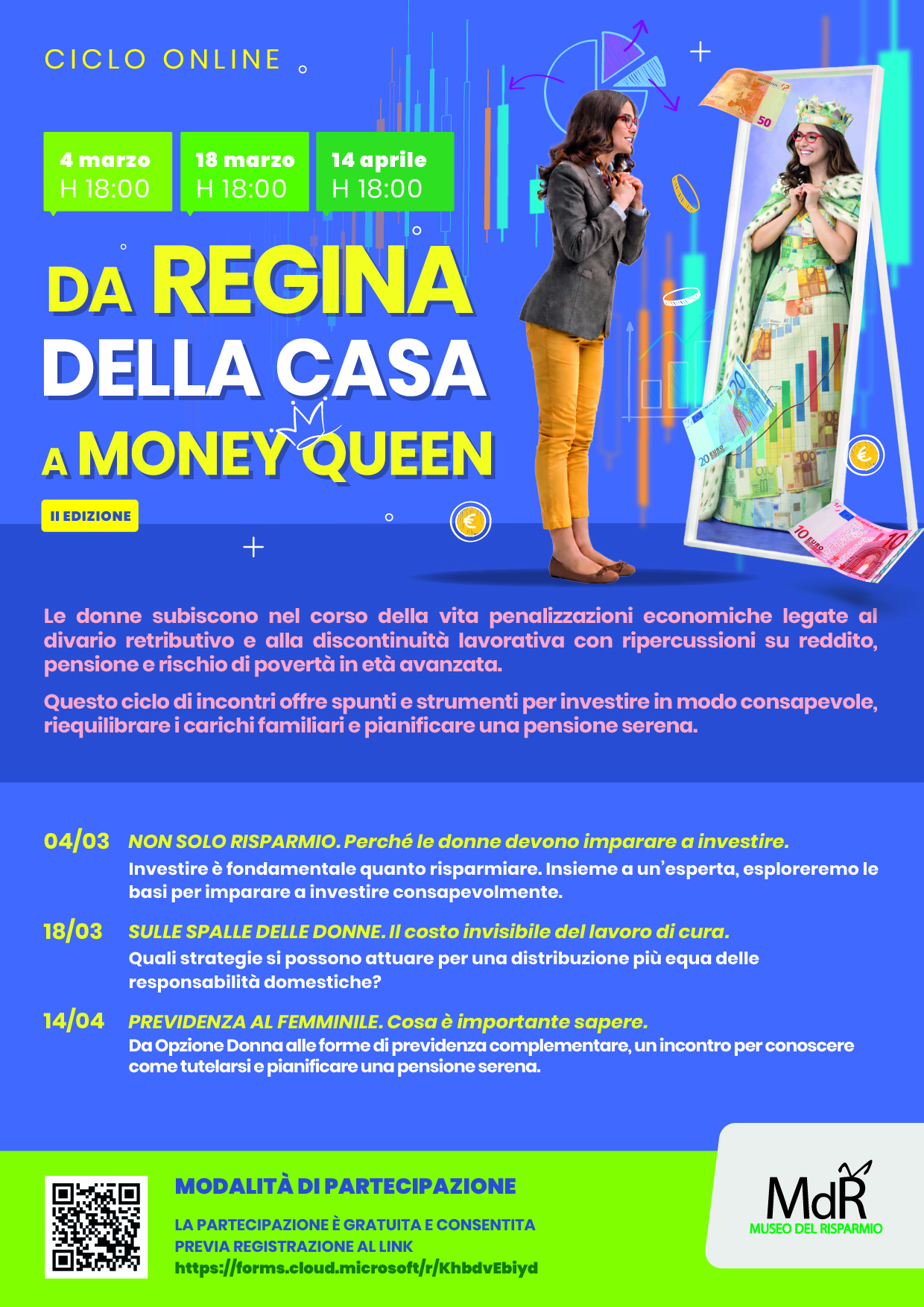

With the second edition of the series “From Queen of the House to Money Queen”, the Museum of Saving aims to provide food for thought and practical tools to learn how to invest consciously, distribute domestic responsibilities more evenly, and plan for a peaceful retirement.

The meetings

4 March, 6:00 p.m. – NOT ONLY SAVING. Why women need to learn how to invest.

Learning how to invest is just as important as saving, especially for women who, for cultural reasons, tend to have a lower propensity for risk. The key is knowing how to define one’s goals, analyze one’s financial situation, and understand the differences between financial products.

18 March, 6:00 p.m. – ON WOMEN’S SHOULDERS. The invisible cost of care work.

Care work, unpaid and carried out mainly by women, is equivalent to an economic value of around 470 billion euros per year, equal to 26% of national GDP. It is invisible work, with heavy repercussions on women’s professional and economic situation. With the contribution of an expert and a psychologist, we will explore the phenomenon and strategies for a more balanced distribution of domestic responsibilities.

14 April, 6:00 p.m. – WOMEN AND PENSIONS. What is important to know.

Women face a significant pension gap due to generally lower wages and frequent interruptions in their working careers (linked to motherhood or care work) and are therefore more exposed to the risk of poverty in old age. From Opzione Donna to supplementary pension schemes, what is important to know in order to protect oneself and plan a secure retirement?

How to participate

The meetings will be held online.

Participation is free of charge upon registration at the following link: https://forms.cloud.microsoft/r/KhbdvEbiyd

Registered participants will receive instructions for connecting via the WEBEX platform.

At the end of the series, it is possible to request a certificate of participation, subject to attendance at all three meetings.